If the tax return has reporting errors like incorrect recovery rebate credit.The tax refunds can take up to four months until received by tax filers.Īlthough there is an exceptional situation at present leading to refund delays for no obvious reasons, the common reasons for longer processing time are as follows: However, the past events in pandemics have created a backlog resulting in delayed tax refunds and late return processing for many tax filers.ĭue to these delays, IRS has stated that the normal tax refund timeline of 21 days is moved to four months. Although the tax refund delays are attributed to errors or inaccurate information in returns. Now to the question of people whose return is taking longer than normal in the processing phase. Related article 2022 Guide to Get W2 Form from Aerotek (For Current & Previous Employees) Why is my return still being processed? Around 9 out of every ten returns filed with the IRS receive the tax return within 21 days.

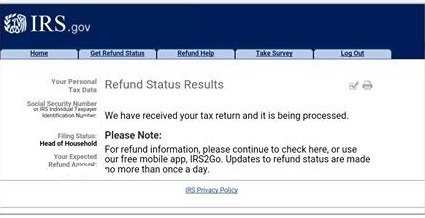

It’s the standard procedure that every tax return has to go through. In the case of paper returns, the refund processing is completed by IRS within 6 to 8 weeks after receiving the return.Īfter processing, it will require 21 days or more for a refund to be shown in your bank account. Once you have filed a paper tax return and mailed it to the IRS, it will take some days to reach the IRS. However, the procedure can be longer if you have filed a paper return. It can take around 21 days for refunds to appear in your bank statement. They start processing the return, and refunds are issued right after processing. What happens once IRS has received my return?Īs soon as you file your tax return using the IRS free tax return filing using the website, the tax return is received by the IRS. In this article, we are going to answer the questions related to tax refund delay, possible reasons why tax return is still under process, and how to fix the problem. Therefore, the same delays can be expected for the tax return of 2021. An estimated nine million taxpayers were waiting for their 2020 tax refund. However, the IRS officials explain the reasons for the delays are due to the backlog. The delays in tax refunds have been higher for the tax years 20. A refund date will be provided when available,’ which further increases the doubts and worries of tax filers. They rush to check the refund status, call the IRS to ask about the refund status, and search the web engine to find similar cases where refunds are delayed.Īnd if the IRS database shows the message ‘Your tax return is still being processed. Right after the tax return filing season ends, the biggest concern of tax filers is receiving a refund on their tax return.Īs soon as the normal processing time passes, worries about refunds surround most of the tax filers.

0 kommentar(er)

0 kommentar(er)